aurora sales tax rate 2021

The Aurora sales tax rate is. Avon OH Sales Tax Rate.

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Depending on the zipcode the sales tax rate of aurora may vary from 675 to 85 every 2021 combined rates mentioned above are the results of colorado state rate 29 the county rate 025 to 075 the aurora tax rate 25 to 3.

. Aurora OH Sales Tax Rate. Aurora property tax rates are the 9th lowest property tax rates in Ontario for municipalities with a population greater than 10K. Loading Do Not Show Again Close.

Aurora in Illinois has a tax rate of 825 for 2022 this includes the Illinois Sales Tax Rate of 625 and Local Sales Tax Rates in Aurora totaling 2. Free sales tax calculator tool to estimate total amounts. Barber County KS Sales Tax Rate.

Method to calculate Aurora sales tax in 2021. The Aurora Utah sales tax is 630 consisting of 470 Utah state sales tax and 160 Aurora local sales taxesThe local sales tax consists of a 150 county sales tax and a 010 city sales tax. Look up 2021 Kansas sales tax rates in an easy to navigate table listed by county and city.

The County sales tax rate is. 2021 Local Sales Tax Rates. Method to calculate Aurora sales tax in 2021.

The City of Auroras tax rate is 8350. You can find more tax rates and allowances for Aurora and Illinois in the 2022 Illinois Tax Tables. The 825 sales tax rate in Aurora consists of 625 Illinois state sales tax 125 Aurora tax and 075 Special tax.

Retailers are required to collect the Aurora sales tax rate of 375 on cigarettes beginning Dec. Aurora colorado sales tax rate details the minimum combined 2021 sales tax rate for aurora colorado is 8. Free sales tax calculator tool to estimate total amounts.

Aurora-RTD 290 100 010 025 375. The 2018 United States Supreme Court decision in South Dakota v. The five states with the highest average local sales tax rates are Alabama 522 percent Louisiana 507 percent Colorado 475 percent New York 452 percent and Oklahoma 445 percent.

6 rows The Aurora Colorado sales tax. The Aurora Colorado sales tax is 850 consisting of 290 Colorado state sales tax and 560 Aurora local sales taxesThe local sales tax consists of a 075 county sales tax a 375 city sales tax and a 110 special district sales tax used to fund transportation districts local attractions etc. Interactive Tax Map Unlimited Use.

You can find more tax rates and allowances for Aurora and Utah in the 2021 Utah Tax Tables. Ad Lookup Sales Tax Rates For Free. The average sales tax rate in Colorado is 6078.

The minimum combined 2022 sales tax rate for Aurora Colorado is. You can print a 85 sales tax table here. The 85 sales tax rate in Aurora consists of 29 Colorado state sales tax 075 Adams County sales tax 375 Aurora tax and 11 Special tax.

This sales tax will be remitted as part of your regular city of Aurora sales and use tax filing. In Alaska the sales tax rate is 0 the sales tax rates in cities may differ from 0 to 7. Has impacted many state nexus laws and sales tax collection requirements.

The Aurora Sales Tax is collected by the merchant on all qualifying sales. The Aurora sales tax rate is. Baldwin City KS Sales Tax Rate.

Look up 2021 Ohio sales tax rates in an easy to navigate table listed by county and city. Axtell KS Sales Tax Rate. Commercial Payment In Lieu General Rate - Excess Land.

Avon Center OH. Did South Dakota v. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate.

The average sales tax rate in colorado is 6078 Quarterly if taxable sales are 4801 to 95999 per year if the tax is less than 300 per month. The current total local sales tax rate in Aurora CO is 8000. Aurora KS Sales Tax Rate.

For tax rates in other cities see Colorado sales taxes by city and county. Baileyville KS Sales Tax Rate. City of Aurora 250.

Aurora Sales Tax Rates for 2021 Aurora in Utah has a tax rate of 63 for 2021 this includes the Utah Sales Tax Rate of 595 and Local Sales Tax Rates in Aurora totaling 035. The Aurora Sales Tax is collected by the merchant on all qualifying sales made within Aurora. 2021 PROPERTY TAX RATES.

Wayfair Inc affect Colorado. Best 5-Year Variable Mortgage Rates in Canada. No states saw ranking changes of more than one place since July.

The Colorado sales tax rate is currently. Ava OH Sales Tax Rate. What is the sales tax rate in Aurora Colorado.

Residential Property Tax Rate for Aurora from 2018 to 2021. There is no applicable county tax. Wayfair Inc affect Ohio.

ENTITY STATE RTD CD COUNTY CITYTOWN TOTAL. TAX CLASS TAX CODES. This is the total of state county and city sales tax rates.

The 8 sales tax rate in aurora consists of 29 colorado state sales tax 025 adams county sales tax 375 aurora tax and 11 special tax. Year Municipal Rate Educational Rate Final Tax Rate. The Sales tax rates may differ depending on the type of purchase.

There is no applicable county tax. You can print a 825 sales tax table here. Skip to Main Content.

5312021 11625 PM. Paul Dillman Created Date. Austinburg OH Sales Tax Rate.

Aurora collects a 16 local sales tax the maximum local sales tax allowed under Utah law. Did South Dakota v. The December 2020 total local sales tax rate was also 8000.

The Colorado sales tax rate is 29 the sales tax rates in cities may differ from 325 to 104. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. Note that failure to collect the sales tax does not remove the retailers responsibility for payment.

With CD 290 000 010 025 375. Austintown OH Sales Tax Rate. Sales Tax The City of Auroras tax rate is 8850 and is broken down as follows.

2021COMBINED SALES TAX RATES FOR ARAPAHOE COUNTY.

Aurora Kane County Illinois Sales Tax Rate

Estimated Effective Property Tax Rates 2008 2017 Selected Municipalities In Northeastern Illinois The Civic Federation

Kansas Sales Tax Rates By City County 2022

Colorado Sales Tax Rates By City County 2022

Illinois Car Sales Tax Countryside Autobarn Volkswagen

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

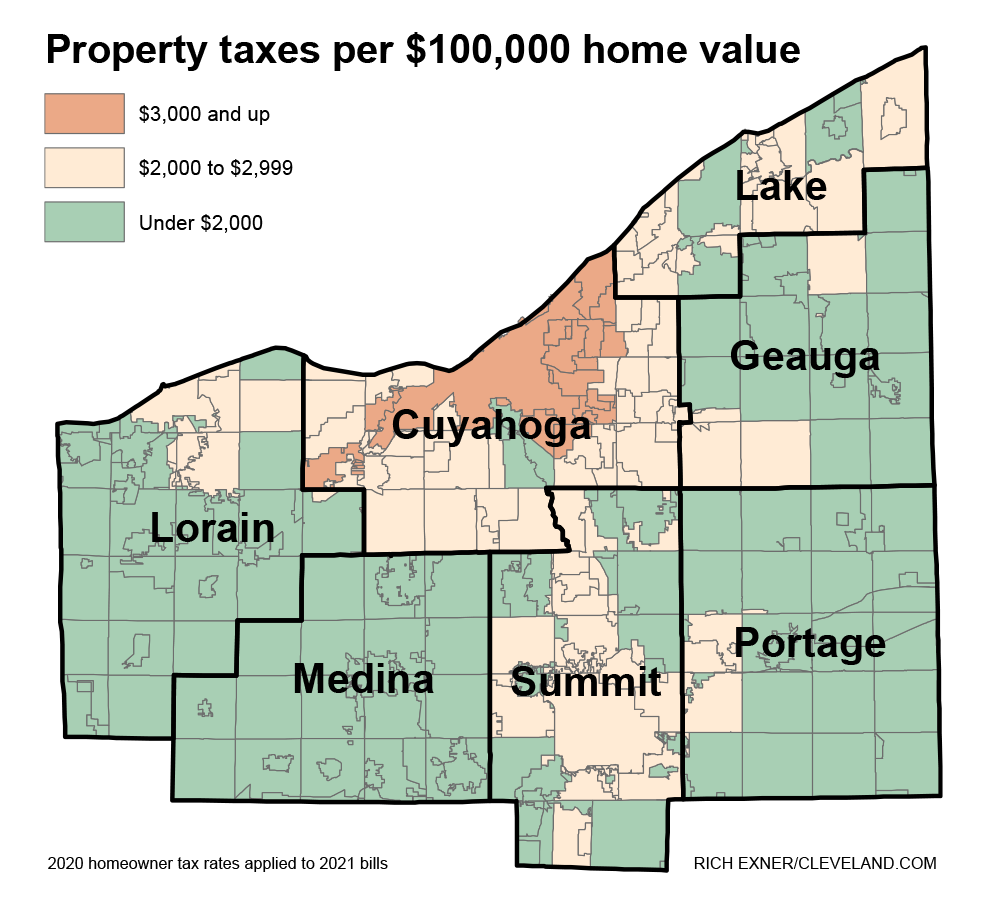

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

Nebraska Sales Tax Rates By City County 2022

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

The Income Tax Rate In Colorado Is 4 63 This Is Not The Only Tax You Will Pay On Your Earnings

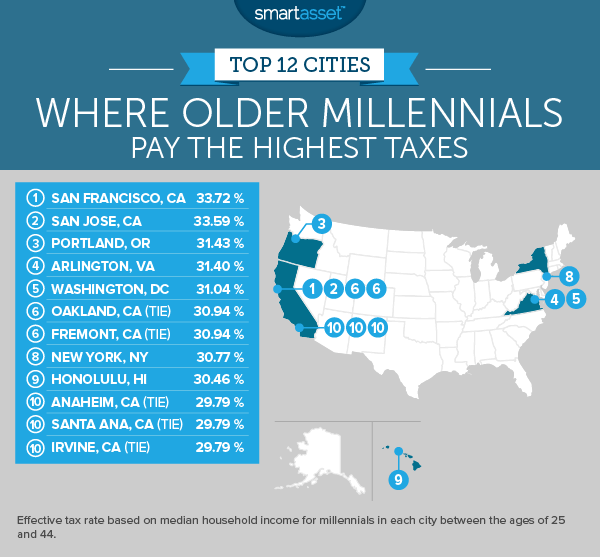

Where Millennials Pay The Highest Taxes 2017 Edition Smartasset

2017 Effective Property Tax Rates In The Collar Counties The Civic Federation

Set Up Automated Sales Tax Center

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Ten Year Trend Shows Increase In Effective Property Tax Rates For Collar County Communities The Civic Federation